Once you’re purchasing a personal loan, you may have three Major selections for lenders: regular banking companies, credit unions, and on the web-only lenders. A lender or credit rating union: A loan from a conventional lender or credit union is usually a great starting point if you have already got a marriage with one.

LendingClub also can make it easy to consolidate debt by featuring direct payment to third party creditors. Borrowers are limited from utilizing resources for postsecondary training, the purchase of investments, gambling and unlawful things to do.

Kiah Treece is a little enterprise proprietor and private finance qualified with knowledge in loans, business enterprise and private finance, insurance coverage and real estate property.

Borrowers may well also have a lot more luck leveraging on line lenders, as on the web lenders are not always confined to some geographical spot.

Co-signer or co-applicant regulations: A co-signer might make it easier to qualify for any loan or assist you to get an even better interest fee, but not all lenders allow them. If you think that you’ll need a co-signer, Restrict your search to lenders that permit them.

We use knowledge-driven methodologies To judge fiscal merchandise and companies, so all are calculated equally. You can read through more details on our editorial suggestions along with the loans methodology to the scores underneath.

three Withdraw Your Loan Amount of money Upon acceptance, the loan amount of money are going to be deposited into your checking account as early as the subsequent organization working day, following which you'll directly withdraw your loan total.

Excellent credit history get more info vital — LightStream loans are designed for individuals with sturdy credit score. If the credit needs some operate, this most likely isn’t the lender for you.

Brigit’s dollars advance is scaled-down than some rivals, but the app presents repayment flexibility and tries to not cause an overdraft payment when it will take repayment.

These lenders operate online or from storefronts and demand triple-digit yearly proportion charges. Loan amounts usually are a few hundred to a couple thousand pounds, and repayment phrases are typically lower than two decades.

Receive cash and start repayment. As soon as you’re approved and obtain the resources, Enroll in autopay to prevent late payments and Create your credit score.

In reality, payment heritage accounts for 35% of your FICO score. Nonetheless, lacking payments or defaulting on a loan can negatively influence your score. That will help using this type of, numerous lenders provide an autopay solution that allows you to routine payments.

Pursuing an extended number of catastrophic misadventures in the Middle East over the past 20 years, the American overseas coverage community has tried to know what went Mistaken. Immediately after weighing the e…

Credit rating necessities: Some lenders give individual loans to lenders with truthful or very poor credit rating, while some have to have very good or exceptional scores. Check out your score prior to implementing after which you can study lenders that match that requirement.

Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Romeo Miller Then & Now!

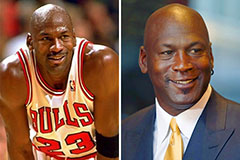

Romeo Miller Then & Now! Michael Jordan Then & Now!

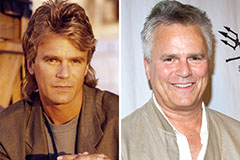

Michael Jordan Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!